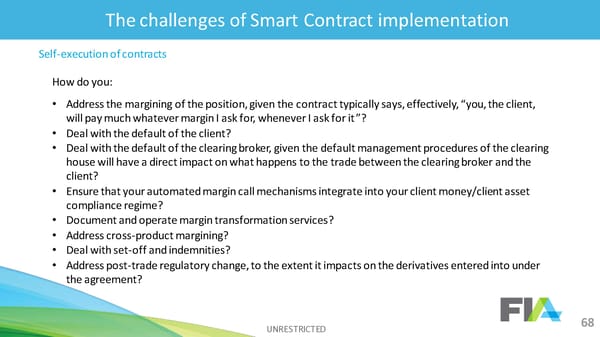

The challenges of Smart Contract implementation Self-execution of contracts How do you: • Address the margining of the position, given the contract typically says, effectively, “you, the client, will pay much whatever margin I ask for, whenever I ask for it”? • Deal with the default of the client? • Deal with the default of the clearing broker, given the default management procedures of the clearing house will have a direct impact on what happens to the trade between the clearing broker and the client? • Ensure that your automated margin call mechanisms integrate into your client money/client asset compliance regime? • Document and operate margin transformation services? • Address cross-product margining? • Deal with set-off and indemnities? • Address post-trade regulatory change, to the extent it impacts on the derivatives entered into under the agreement? UNRESTRICTED 68

2nd R3 Smart Contract Templates Summit (All Slides) Page 68 Page 70

2nd R3 Smart Contract Templates Summit (All Slides) Page 68 Page 70